Whether you are a business owner wanting to install a renewable energy system, a homeowner looking to produce green energy at your residence, or an agricultural producer wanting to supply clean energy to your farm, you can receive a federal tax credit for installed solar systems!

This is not a deduction, but an actual credit against the taxes that you owe. In the event that your tax burden does not have an appetite for the full credit in one calendar year, you can simply apply the excess credit to future years.

As for getting down to the numbers, the credit is 26% for systems placed in service in 2021. It will stay at 26% for 2022, and then drop to 22% for those installed in 2023. At present, residential systems installed after 2023 will not have a credit and commercial/ag systems' credit will drop to 10%.

WindSolarUSA, Inc. will work with you and/or your tax professional to ensure that all necessary paperwork and documentation is completed and provided for a seamless filing. For more information about the tax incentives available to you, visit this site.

Still a little confused about how going solar can provide a tax credit? Let a WindSolarUSA, Inc. professional explain things in greater detail. Contact us today for your free consultation!

Bringing affordable solar, utilizing American-made products, to all of Illinois

Click here

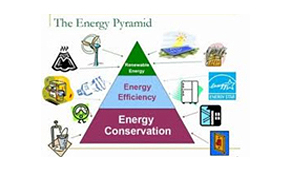

The first step to any renewable energy project is energy efficiency. New advances in the energy management

Read more

WindSolarUSA, Inc. works with distributors and manufacturers to be able to offer you

Read more

If you can imagine it, we can design it. From flush mounted residential roof mounts, to expansive commercial

Read more

WindSolarUSA, Inc. offers consulting services that can benefit individuals, companies, municipalities,civic

Read more

Are you interested in learning more about renewable energy for your home, business or farm? Take advantage

Read more

Free, no-obligation site visits are included to help you decide if solar is right for you! Want to ensure you have

Read more

Our staff handles all of your permitting and utility applications, renewable energy credit processing

Read more